Let the software do the work for you automatically

Get notified when an unusual transaction occurs

Real time bank connections for instant transaction monitoring

How does it work?

Create transaction profiles

Determine the expected transactions and create profiles based on predefined business rules.

Automatically monitor transactions

Automatically monitor imported transactions and get notified of unexepected transactions.

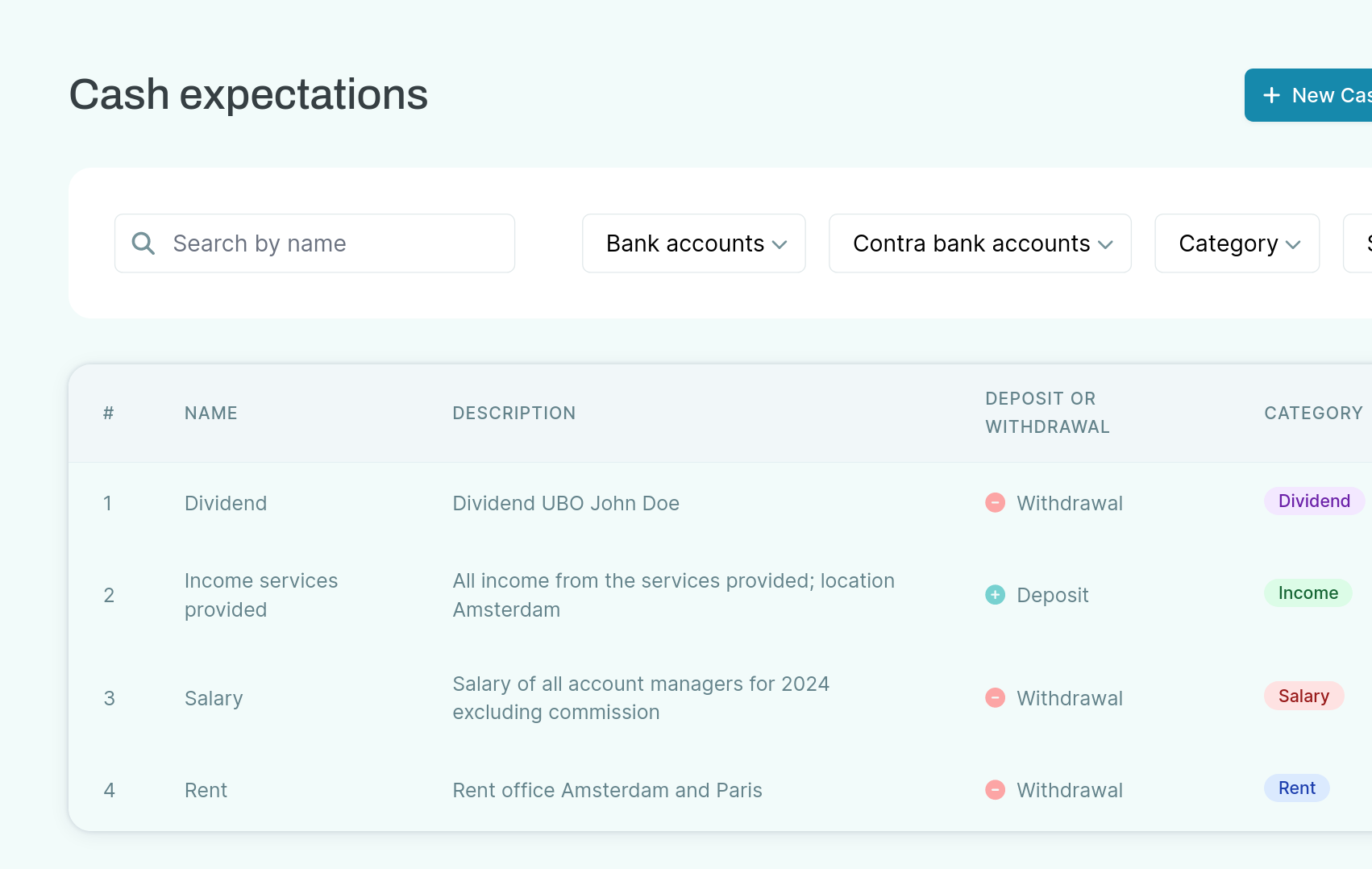

Create transaction profiles

Strategically creating transaction profiles plays a pivotal role in the transaction monitoring process, allowing institutions to monitor transactions effectively.

-

Profile creation is done with a set of predefined business rules used to assess the legitimacy of transactions.

-

A comprehensive profile includes components as transaction amounts, frequency limits and client behavior patters.

-

Sort the transaction profile into categories such as VAT, rent or dividend, for a clear overview.

-

An integrated workflow so that the transaction profile always remains up-to-date.

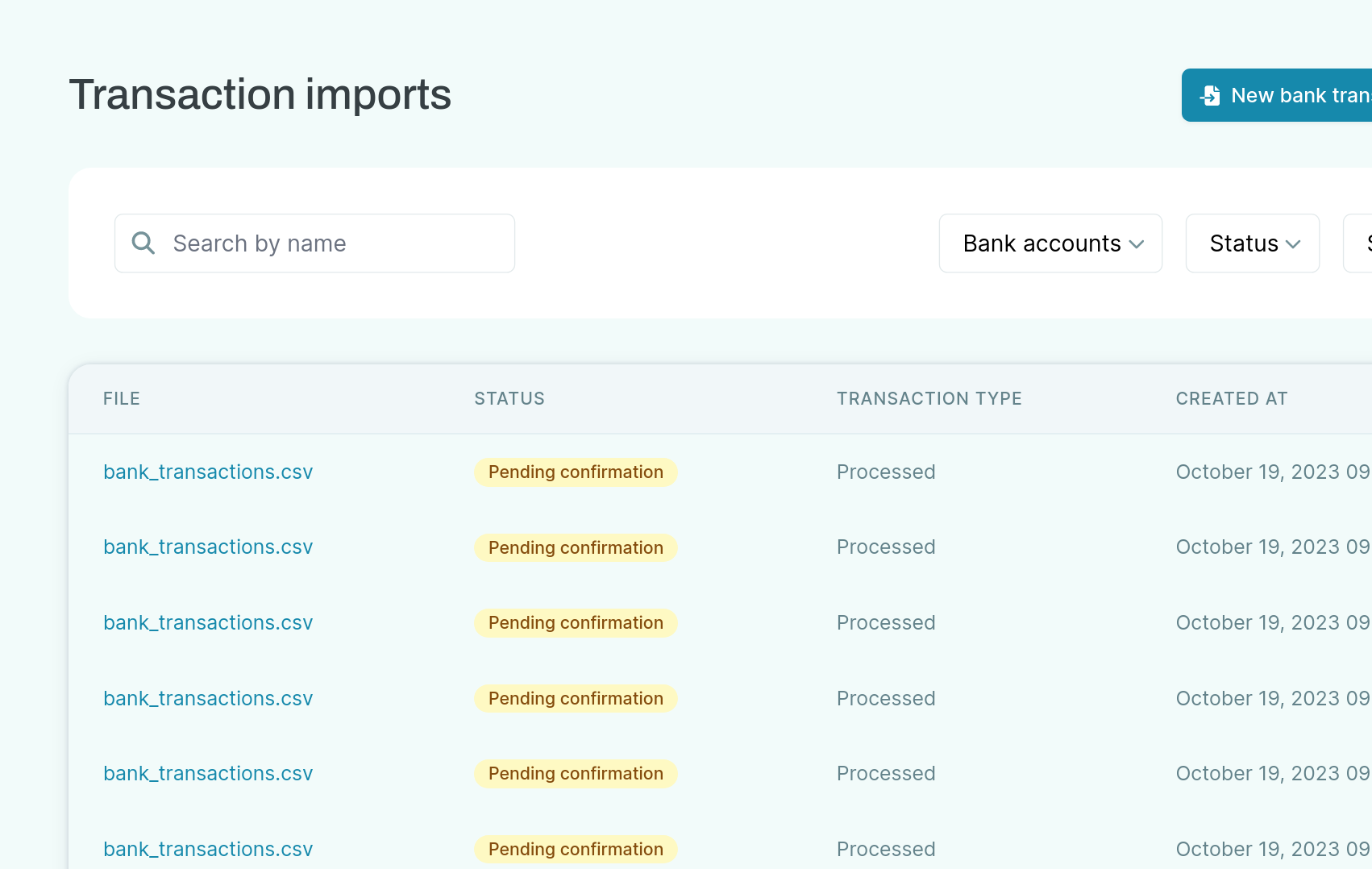

Import bank transactions

Import your transactions into the system and let the software do the work for you.

-

Real time bank connections for instant monitoring of transactions as they occur.

-

Coverage of 2200+ banks using direct bank connection.

-

Or create your own bank statement formats to import manually.

-

Coverage of all banks that export bank statements in CSV.

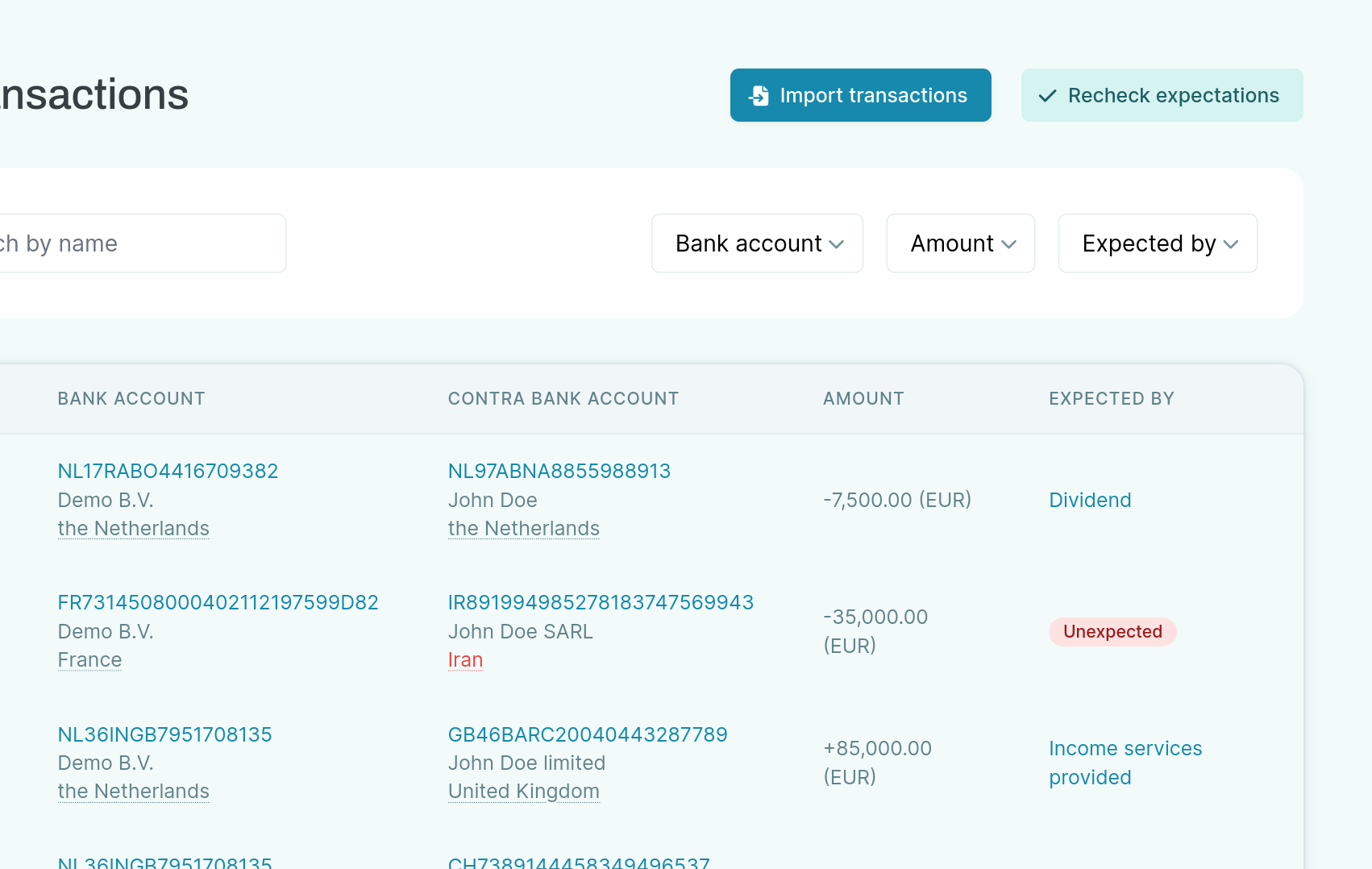

Transaction monitoring

A systematic process to analyze transactions continually. This process aims to identify unusual transactions that may indicate money laundering.

-

When our system identifies unusual activities, it generates alerts automatically.

-

Both real-time monitoring and batch processing.

-

Monitor both planned and processed transactions.

-

Assess the situation, gather additional information and decide whether to take appropriate action.

Connected bank coverage

Discover which banks we support for automatically importing transactions. Is the bank you are doing business with not listed? Please contact us to discuss whether we can add this bank connection.

Bank not found?Don't worry, these are just the banks we currently have a direct connection with. Please contact us to learn if we can connect with your bank via other means. |

Tailored solutions, for  everyone.

everyone.

Basic

Unlimited users

Manual import

10 dossiers included

1.000 monitored transactions p/m included

20 connected own bank accounts included

Essentials

Unlimited users

Automated and manual import

25 dossiers included

2.500 monitored transactions p/m included

50 connected own bank accounts included

Pro

Unlimited users

Automated and manual import

100 dossiers included

10.000 monitored transactions p/m included

250 connected own bank accounts included

Enterprise

Are you a business with over 500 dossiers or a strong interest in utilizing our API? We offer custom pricing for large-scale clients. Contact us to discuss your specific needs.